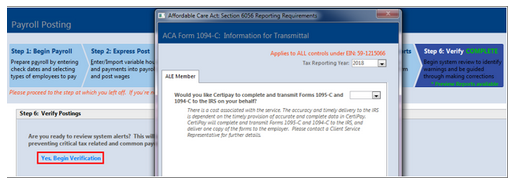

ACA Transmittal Pop Up

ATTENTION: Starting September 1st, 2023, the ACA Transmittal will be activated within CertiPay.

Once payroll has been verified, you will receive a prompt asking whether you'd like CertiPay to handle the filing of your 2023 1094 & 1095-C forms. Please respond with a 'Yes' or 'No'. If you choose to bypass this notification, it will continue to appear until November 3rd each time you process payroll.

Once you've made your choice, the prompt will no longer appear during payroll. If you select 'No' and your business requires ACA reporting, the responsibility for filing the 1094 & 1095-C forms will rest with your organization. If you find that you marked 'No' in error or require any modifications, please don't hesitate to contact Client Solutions. They will gladly assist in updating the transmittal on your behalf. If you do not have the authority to make this decision, please make sure to engage the relevant individuals who are responsible for finalizing such decisions.

Alternatively, if you opt for 'Yes' and wish for CertiPay to manage your ACA forms, it's crucial to maintain CertiPay to ensure compliance with the Affordable Care Act regulations. Please note, CertiPay does not automatically verify ACA compliance or update employee profiles. If you want to enroll in additional services to assist with ACA compliance and HR profile updates, please reach out to your dedicated service department.

Below is a detailed guide on how to populate the ACA Transmittal.

|

Question/Information Required |

Description |

How to answer |

|

Would you like CertiPay to complete and transmit Forms 1095-C and 1094-C to the IRS on your behalf? |

If you are required to report and would like CertiPay to report on your behalf, select YES. |

ACA reporting is required for ‘Applicable Large Employers’ also known as ALEs that have 50 or more full time/ fulltime equivalent employees. The Fulltime/Fulltime Equivalent Employees report within CertiPay can be reviewed for the prior calendar year to determine if an employer is required to report for the current year. |

|

Enter the name and telephone number of the person to contact who is responsible for answering any questions related to the Form 1094-C. |

The email address will also be required for the contact listed. CertiPay will send important news to the email listed on the transmittal. |

The individual listed will need to be someone that should be contacted by the IRS and has POA to speak on behalf of the entity. |

|

Was the EIN a member of an Aggregated ALE Group during any month of the calendar year? |

If your company is affiliated with any other company during the tax year, then answer 'YES'. If your company operates independently and is not associated with any other company of common ownership, then answer 'NO'. |

Companies can be affiliated with one other by being a sister company, parent company, or having similar ownership. Please review the IRS publications to determine if this applies to your entity. |

|

Is the EIN eligible for and using the 98% Offer Method? |

The answer is preset to 'NO' and can no longer be adjusted. CertiPay does not generate forms based on the different reporting requirements associated to the 98% Offer Method. |

Standard IRS regulations require employers to offer at least 95% of its Fulltime employee’s health coverage each month to remain in compliance. |

|

Is this employer eligible for 2015 Section 4980H Transition Relief? |

The answer is preset to 'NO' as it is no longer applicable. |

Please disregard. |

|

If you answered 'YES' to the question regarding being a member of an ALE an additional tab will appear. |

Mark the months for which the company was part of the aggregate group. Mark the months for which the company was part of the aggregate group. |

If the related entities are also controls processing payroll within CertiPay, the ‘Retrieve Other Controls’ feature will pull all of the controls names and EIN’s in to the list, if not the information can be added manually by selecting ‘Add’. |

|

CertiPay is now offering health mandate reporting. If you are required to report for CA, NJ, DC, and/or RI please select all that apply. |

This is applicable if employees reside in CA, NJ, RI or if employees reside in or work in DC. |

If you are unsure that you have employees applicable to the state health mandate reporting, the ACA Form 1095-C by state will determine who is to be included. This report is based on the state taxes processed not the state on the employee’s profile. |